Diversification: a question of risk

The Importance of Diversification

It is true that diversification is one of the most effective ways to help manage your investment risk. So what exactly is diversification and how does it affect your investment?… To start off, it is a strategy used to spread your money across various asset classes, sectors and/or industries to aid in offsetting a loss in any one investment. In other words, it aims to finds the balance between risk and return by investing in different areas of the market that would react differently to the same situation or event.

Consider an example: Store A sells strawberry ice cream and strawberry sorbet; while Store B sells strawberry, mango and granadilla sorbet. Both have a level of variety, but are different in their approaches to that level of variety. Store A only sells one flavour, but variety comes in with selling ice cream and sorbet. Store B only sells sorbet, but variety comes in with selling different flavours. Now, let’s say that an environmental event occurs that causes a drastic shortage in strawberries that affects both stores. Store A may struggle because; while there may be variety in the ice cream and sorbet offerings, the core fruit ingredient is compromised. Store B on the other hand is still protected because it can still sell the two other flavours and potentially earn a profit. Strawberries have only affected a fraction of Store B’s sales, which would be offset by the profit earned on the other flavours. Store B is a simple example of just how important diversification is.

It all stems from Modern Portfolio Theory by Harry Markowitz in which his journal article – titled “Portfolio Selection,” and was published in the Journal of Finance in 1952 – speaks to the importance of diversification in achieving an efficient portfolio. The article highlights the significance of how a less positively-correlated (the degree to which two elements of a group are acting in a similar way given certain conditions. Eg. 2 stocks in a portfolio) and more negatively-correlated portfolios (when the securities that make up the portfolio act in opposite ways given certain market conditions) can achieve a well-diversified portfolio.

Keeping the Store A and Store B analogy in mind; markets can be unpredictable and volatile; which is why we need to invest in different ‘flavours’ in an attempt to offset losses (downside risk) and achieve higher gains. Contextualising this, we see that there is a need to balance both investment risk and portfolio returns through the use of diversification.

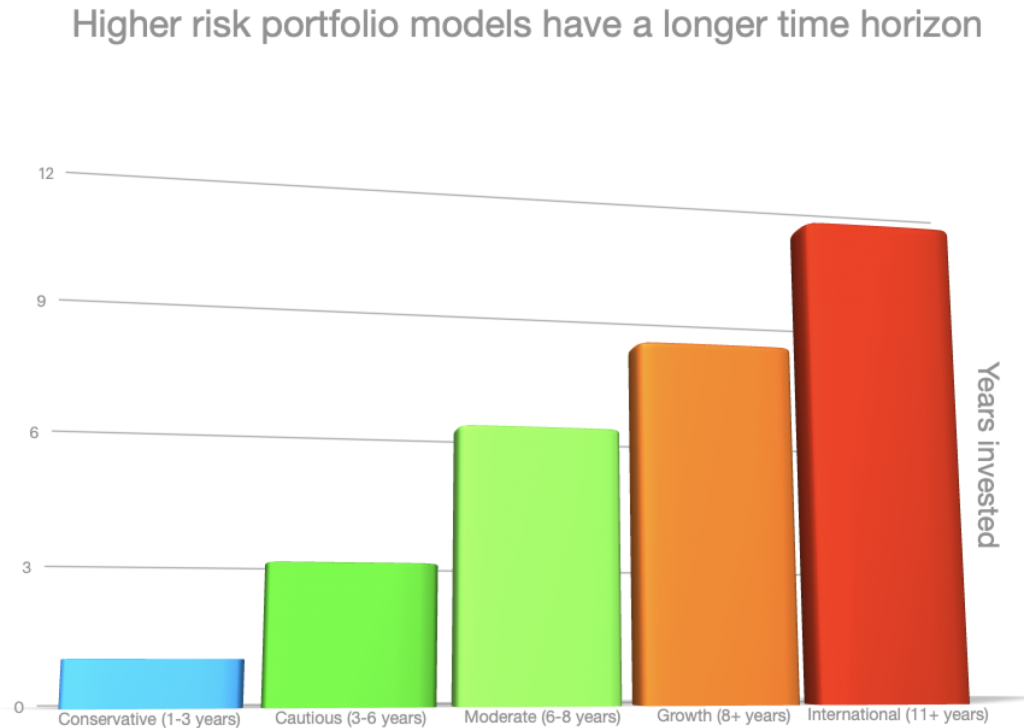

Considering our risk scale, you have cash and cash equivalents on the lower end, bonds and property in the middle, and equities on the high end, with longer holding periods. There is a very clear reason for this being the case. The more volatile an asset class is, the longer one will have to hold onto it (what is known as a longer investment time horizon) in order to obtain a greater amount of certainty in returns. The relationship between risk and returns is linear. The greater the risk that you take on in a portfolio, the greater the potential returns earned all things considered.

By diversifying your portfolio you want your investment to grow without exposing yourself to extreme losses in an unfortunate event of market turmoil. Generally speaking, equities and bonds tend to be negatively correlated, so when the stock market is up, investors tend to buy into equities, and when stock market is down, investors tend to buy into bonds. What this tells us is that by holding various asset classes in various quantities (weightings), we can achieve a certain degree of diversification. Diversification is not without its shortcomings, and some inherent risks cannot be full diversified out of the portfolio (what is known as systemic risk).

Looking at diversification as an applicable concept closely; we have established that the ideal investment or portfolio should have a spread across various asset classes, sectors and/or industries. Making use of calculative tools that enable us to accurately quantify correlation and obtain optimal diversification for a given set of market conditions, we are able to reduce our risk budget (how much risk we are willing to take on) and obtain high returns for a given risk level.

Coming back to the earlier analogy, we also know that balancing the risk and return of these ‘flavours’ is important, but purchasing different flavours of sorbet is more expensive than purchasing just one flavour. Diversifying your investment may be considered expensive too; not all investment instruments cost the same and taking transaction costs and broker fees into account, you may end up with less total returns than you anticipated or even lower than the market return.

One way to solve this problem is by investing in the market with low fees through index-based securities such as ETFs (Exchange Traded Funds). By investing in ETFs, your investable universe becomes so much larger and you obtain broader market access with one simple investment action.

ETFs are funds that invest in a basket of securities that make up some or other securities index, sector or market benchmark. They are listed directly onto the stock exchange, and traded daily in the same way one would shares. These can be bought and sold within the same day- just like stocks, making them highly liquid. In fact, ETFs are registered as (CISs) Collective Investment Schemes – commonly known as unit trusts. Some of the main differences between mutual funds and ETFs are that ETFs offer lower fees, more transparency and the ability to be traded as frequently as required throughout the trading day. Because ETFs represent indices, asset classes, industries or sectors, so they offer instant diversification at low cost.

Diversification enables you to combine your desired ‘flavours’ to achieve a desired return with a risk band that you are comfortable with. An important aspect to highlight here is that it all depends on your goals, risk tolerance and time horizon. This means finding the right strategy that works for you and blends all of this together. Some may argue that investing in passive securities is not enough. The reality is that active and passive strategies are each useful in their own right depending on the prevailing market conditions at the time.

At Index Solutions, we believe in hybridising the best traits of both active and passive solutions in our investable products through our ‘off the shelf’ risk adjusted model portfolios and Global Explorer Note at low cost. In terms of our multi-asset model portfolios, these can be integrated and unitised into building blocks that are customisable. Looking at it from this perspective, it sounds simple and it is. Achieving diversification is not complicated, you simply need to find the best blend that works for you.